How To Create a Mindful Budget

Hi friends,

Today I wanted to talk a little bit about money. I know, it’s that taboo topic that we’d all really rather ignore but it’s in most of our faces on a daily basis {that rhymed, how cute!} There are so many resources and ways to create a mindful budget. I’ve actually been feeling like I need to make some personal changes in regards to money lately. Time is flying by. Retirement is closer than we think {a financial advisor reminded us of that recently! #eyeopening } My oldest also started high school last week {wierd cause I swear I am still 30! ;)} so college is coming up f-a-s-t!

Creating a mindful budget is a great way to stay on course with your finances {personal and business}.

Tips for creating a mindful budget:

- Track your spending

- Create a budget

- Check in monthly for necessary adjustments {bi-monthly bills, etc}

- Check in daily and weekly to catch any issues, over spending, etc.

Finances are personal and unique to each individual. Everyone has different incomes and monthly bills. You need to find what works best for your household. I have found several different options for creating budgets to share with you.

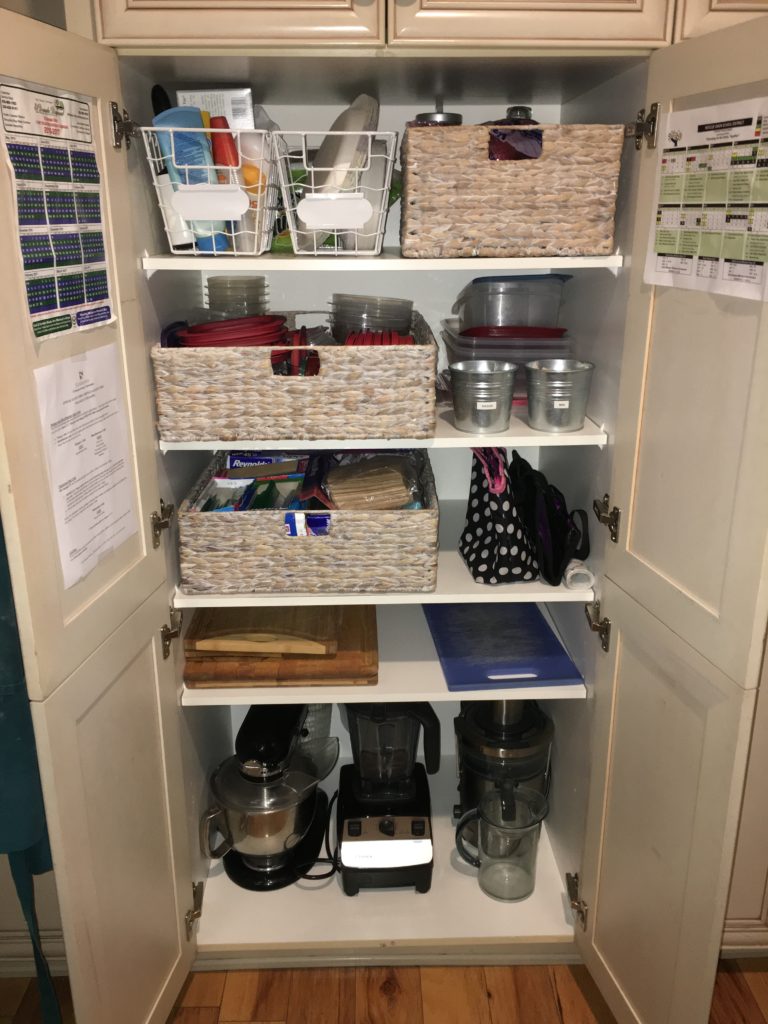

Also, I have to say that sometimes figuring out where to cut can be quite obvious. For me? It’s avoiding places like Home Goods and Marshalls {which I love so much so this is very hard for me}. If I avoid these places, I also avoid the temptation of impulse purchases which = money in my bank account.

I am forever pinning ideas on budgets. The problem is, I don’t look back. Every paycheck I wish there was more leftover. I wish I putting more towards savings/retirement/college. I swear I will budget ‘next pay day‘.

I stumbled upon Cait Flanders . I have to say, I didn’t just look at her worksheets or pin it to come and view later. I subscribed. I read her story and some of her ‘whys’ really resonated with me. I signed up for her budgeting worksheets {which always seem a bit intimidating}. I love her logic. She says that “a budget helps you do the most you can with the money you have”. This is a very great point as we each have a very different starting point with our bills and income.

Another obvious and cohesive point with all of the various budgeting apps and worksheets is that you have to keep track of what you spend on everything. Keeping track = being accountable. The same goes for diets. Those who have the most success, typically write it all down. This can help keep you in check.

My personal tracker for our monthly bills is an excel spreadsheet. This only keeps track of what bills I need to pay and what money is left to spend on variables. It isn’t a complete budget. A budget would tell me where that excess money could and should go.

Dave Ramsey is a super popular finance guru. I know a lot of people who have had extreme success with his programs. He has the infamous envelope system that really seems to work.

You’ll want to find a system that works for you. Whether this is an app, spreadsheets, notebook or even an awesome printable. I am sharing several options and resources below.

BUDGET PRINTABLES:

Frugality Gal shares 20 budget printables here.

Clean and Scentsible offers her payment tracker here.

Printable Crush shares her simple budget worksheets here.

Smart Money Simple Life shares 11 budget printables here.

Shiny Mom offers this monthly bill payment organizer here.

APP SITES:

APPS:

FINANCE BLOGS:

10 QUICK WAYS TO SAVE $

- Make coffee at home {goodbye Starbucks}

- Cut cable

- Negotiate your interest rates on credit cards

- Eat out less {a family dinner out for our family of 4 costs around $70 + tip}

- Find free activities {click here for some awesome options}

- Wash your own car {the average price for a car wash is $25+}

- Do your nails at home

- Renegotiate your bills. I just did this yesterday with XM radio.

- Meal plan!! Use ads and apps to figure out what is on sale. I just downloaded Flipp.

- Workout at home. There are so many ways to stream workouts straight to your living room!

Are you a mindful budgeter? Do you have a system that is share worthy? I’d love to hear it!

Excuse my break from the fun posts today. Sometimes I like to insert a little bit of business up in here. Cool? 😉

xo,

Gabby

Thank you for this article. I found it both interesting and insightful. Being a mom of three, I agree with you that budgeting is definitely an important part to organizing. x

Found I have managed to save some money thanks to this article… You made me relook at my budget x

Thank you again for such a brilliant website x